This is demonstrated through. A 1512012 on The Returning Expert Programme at the Official Portal of Lembaga Hasil.

Indonesia S Fight Against Climate Change Carbon Taxes And Beyond International Tax Review

This rule shall not apply to qualifying companies granted an exemption on or before 16 October 2017.

. Any excess is not refundable. The following incentives are given to encourage investment and relocation of manufacturing or services operations into Malaysia. Income attributable to a Labuan.

The difference of RM2 million increased in year of assessment 2017 will be taxed at 20 per cent equal to RM400000. ITA of 100 on QCE set-off against 100 of SI. Manufacturer of selected ME and specialised ME.

The reduction of the SME income tax rate on the first RM500000 by 1 is also a welcomed change. In Malaysia the corporate tax rate is now capped at 25. Companies that are about to establish their presence in Malaysia are allowed to apply for 0 to 5 tax rates based on the investments and commitments to job-creation.

1 - 4 Fill in relevant information only. Goods Services Tax GST Updates 31. 0 to 5 Tax Rates for Incoming Companies.

Manufacturers producing promoted products or engaged in promoted activities. ITA of 60 on QCE set-off against 70 of SI. The applications must be submitted to Talent Corporation Malaysia Berhad.

Major highlights for 2017 Malaysia Budget Marginal reduction of the corporate income tax rate on the annual incremental chargeable income for YAs 2017 and 2018 Reduction of corporate. As part of the governments strategy to attract companies to establish their regional trading hubs in Malaysia the budget introduces a new Global Trading Center tax incentive through which businesses are eligible for a concessionary tax rate of 10 percent for a period of five years. 0 tax rate for 10 or 15 years for new companies that invest a minimum of MYR 300 million or MYR 500 million respectively in the manufacturing sector in Malaysia.

Malaysia is also committed to align themselves to the global standards. PS with tax exemption of 100 of SI. Tax incentive for women returning to work after career break It is proposed that a new tax exemption on employment income up to a maximum of 12 consecutive months be given to women who return to the workforce after a career break of at least 2 years on 27 October 2017.

Many tax incentives simply remove part or of the burden of the tax from business transactions. PS with tax exemption of 70 of SI. This article is relevant for candidates preparing for the P6 MYS Advanced Taxation exam.

The article is based on prevailing laws as at 31 March 2017. In the past the tax rates of these companies were 0 5 and 10. 6 2016 Amendment Order 2018 PU.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited DTTL its global network of member firms. This means the effective rate is 233 per cent and the total amount of tax to be paid is RM28 million with tax saving of RM80000. This PH tax incentive is very timely in Malaysia.

PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope. Individuals chargeable income does not exceed MYR 35000. A7 Entitled to claim incentive under section 127 2 Approved donations gifts contributions 7 - Gift of money to an approved fund.

For the item Income Tax No. See Terms of Use for more information. This will be renewable for another five years.

If husband and wife are separately assessed and the chargeable income of each does not exceed MYR 35000. Sources outside Malaysia - 1 - c PU. Wong Partners Highlights of the Malaysian Budget 2017 4 Percentage Increase In Chargeable Income Compared To The Immediate Preceding YA Percentage Reduction Corporate Income Tax Rate on Additional Chargeable Income After Reduction Less than 5 NIL 24 5 - 999 1 23 10 - 1499 2 22.

Nevertheless a company eligible for a certain tax incentive might only pay an average effective tax rate of 75 with only 30 of the companys profit being subjected to tax. Tax Incentives for Economic Development Regions 3. Resident individuals are eligible to claim the following tax rebates which are to be deducted from tax charged.

Malaysian Customs Department and the Companies Commission of Malaysia. Relevant Orders Income Tax Exemption No. As highlighted in earlier tax alerts the financial incentives under the Multimedia Super Corridor MSC Malaysia Bill of Guarantee No.

5 BOG have been reviewed and amended to adhere to the minimum standards under Action 5 of the Organization for Economic Cooperation and Development OECDs Base Erosion and Profit Shifting BEPS Project see Tax Alert. The new scheme for encouraging business growth by reducing the income tax rate by 1-4 for increases in chargeable income is a step in the right direction. These income tax rate.

The article is written to provide an overview of the venture capital industry in Malaysia and the governments effort in promoting this industry and made reference to the Public Ruling 22016 Venture Capital Tax Incentives.

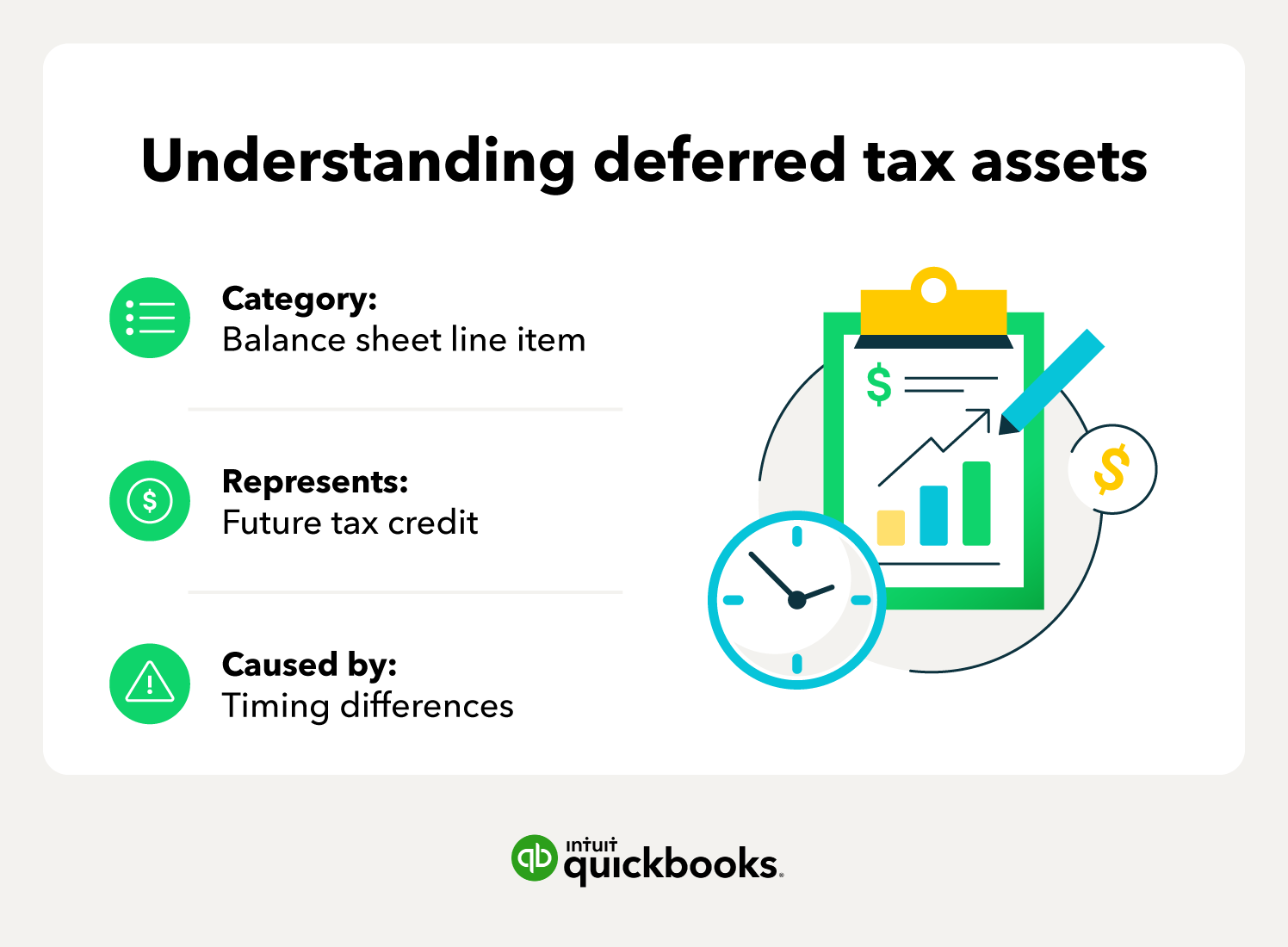

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Measuring Tax Support For R D And Innovation Oecd

Labuan Offshore Company In Malaysia

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

1 Nov 2018 Budgeting Inheritance Tax Finance

75 R D Super Deduction Extended Raised To 100 For Kpmg China

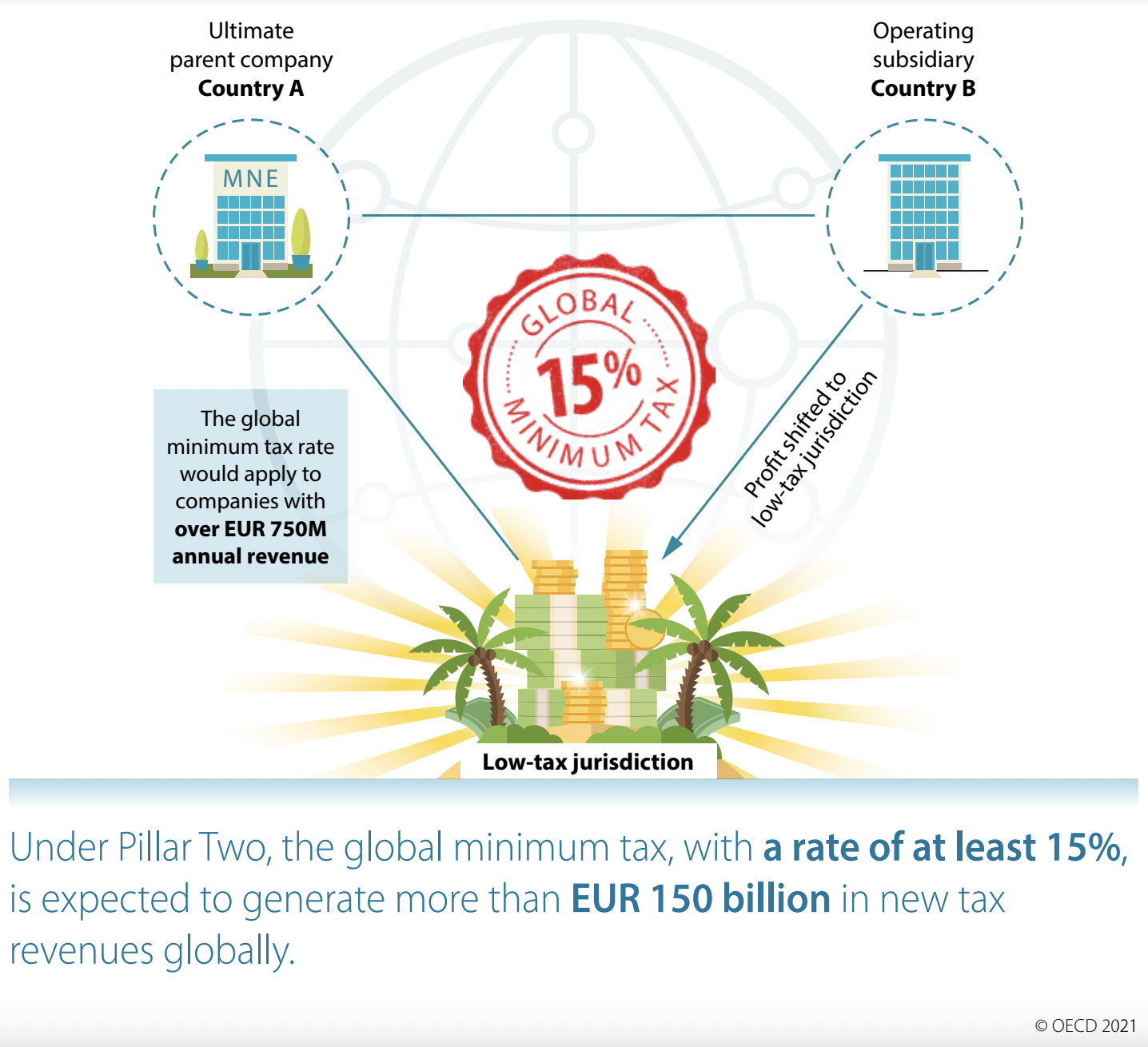

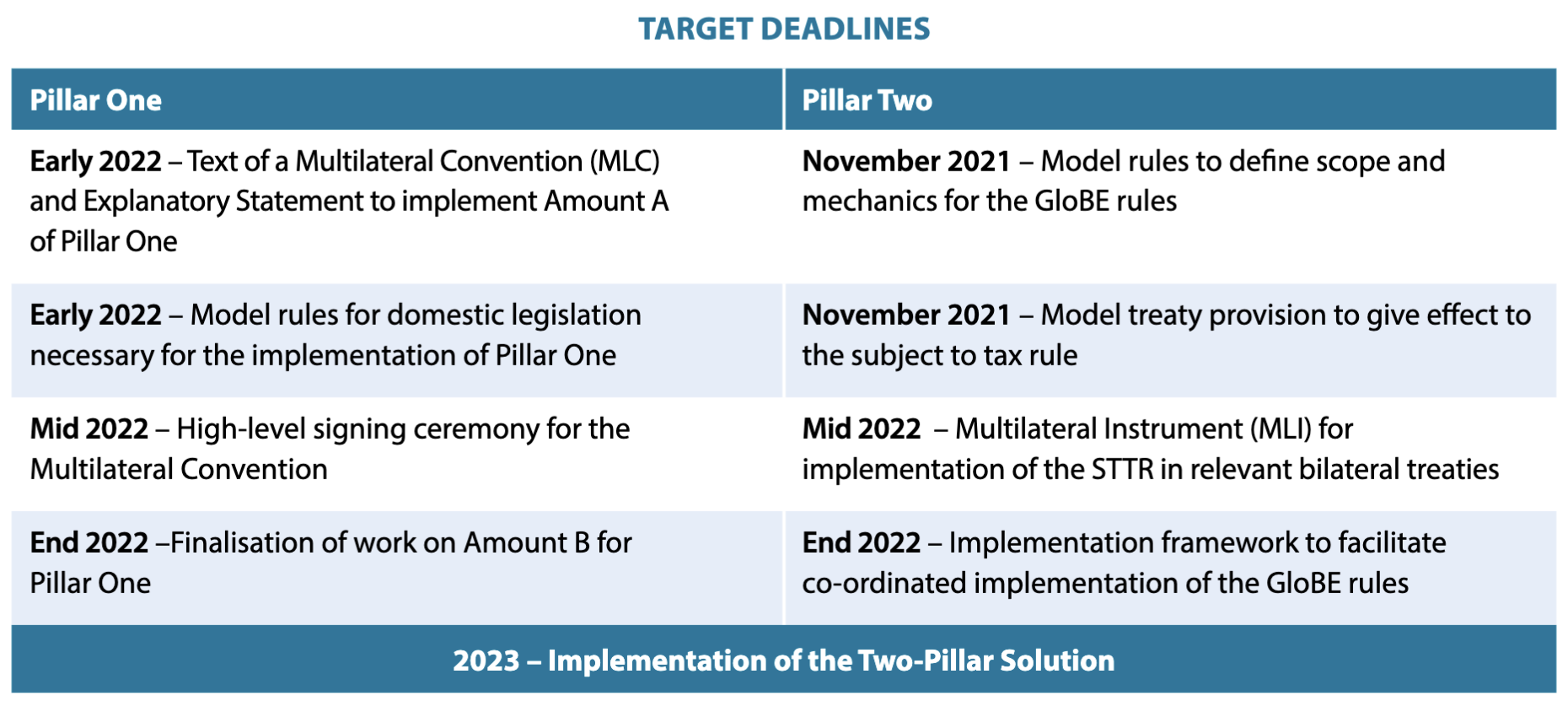

Digital Taxation In 2022 Digital Watch Observatory

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Digital Taxation In 2022 Digital Watch Observatory

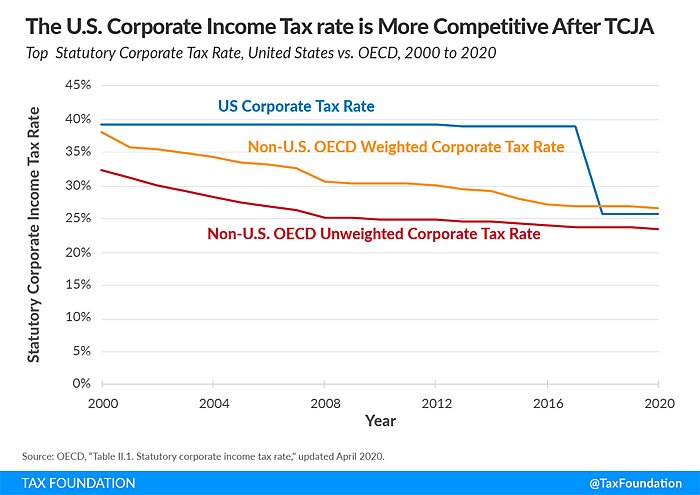

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

1 Nov 2018 Budgeting Inheritance Tax Finance

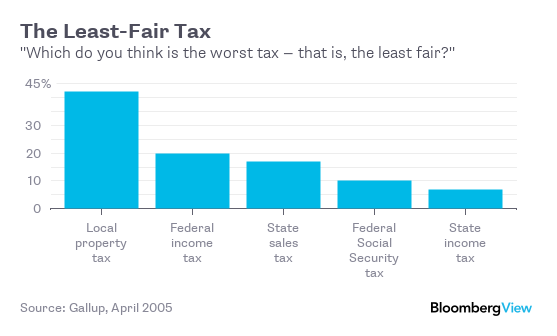

Why Economists Love Property Taxes And You Don T Bloomberg

Malaysia S Mof Has No Power To Restrict Investment Allowance Claim International Tax Review

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

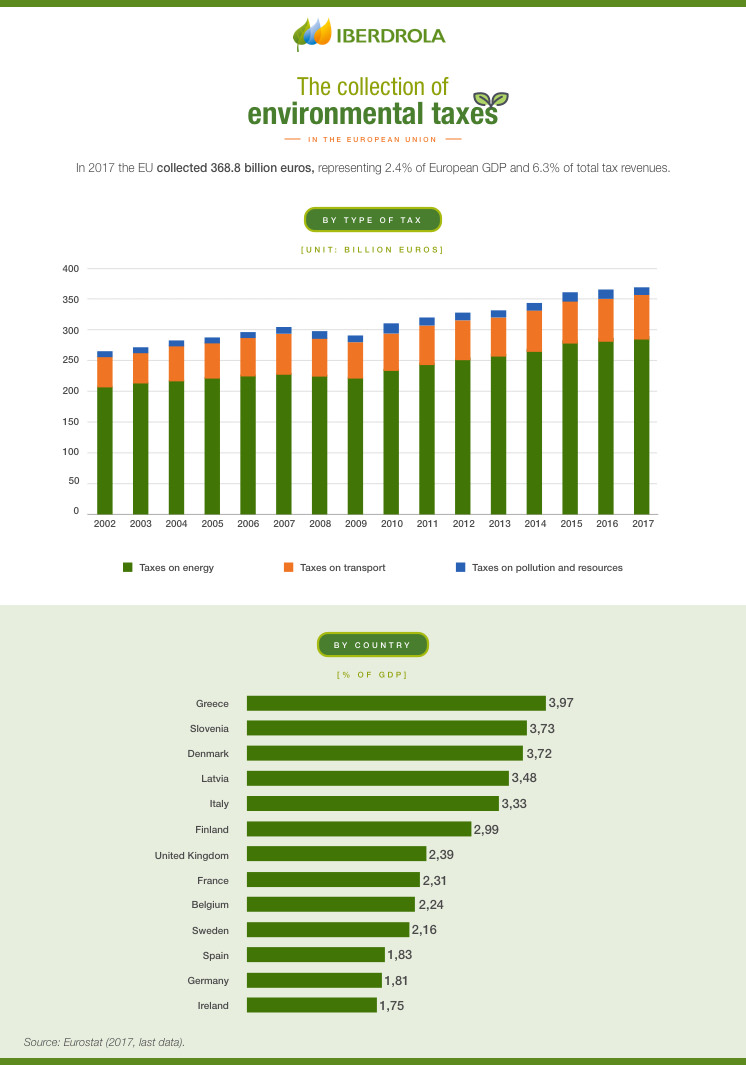

What Are The Green And Environmental Taxes Iberdrola

Doing Business In The United States Federal Tax Issues Pwc